A Biased View of Pvm Accounting

A Biased View of Pvm Accounting

Blog Article

The 2-Minute Rule for Pvm Accounting

Table of ContentsUnknown Facts About Pvm AccountingThe Main Principles Of Pvm Accounting Some Known Incorrect Statements About Pvm Accounting Pvm Accounting - TruthsPvm Accounting for DummiesPvm Accounting Can Be Fun For Everyone

Ensure that the audit process abides with the legislation. Apply required construction accountancy standards and treatments to the recording and coverage of building task.Connect with numerous financing agencies (i.e. Title Firm, Escrow Firm) concerning the pay application process and requirements needed for payment. Aid with implementing and maintaining inner economic controls and treatments.

The above declarations are meant to explain the basic nature and degree of work being carried out by people designated to this classification. They are not to be interpreted as an exhaustive list of obligations, tasks, and abilities called for. Personnel may be called for to execute obligations outside of their normal duties every so often, as needed.

Pvm Accounting Things To Know Before You Get This

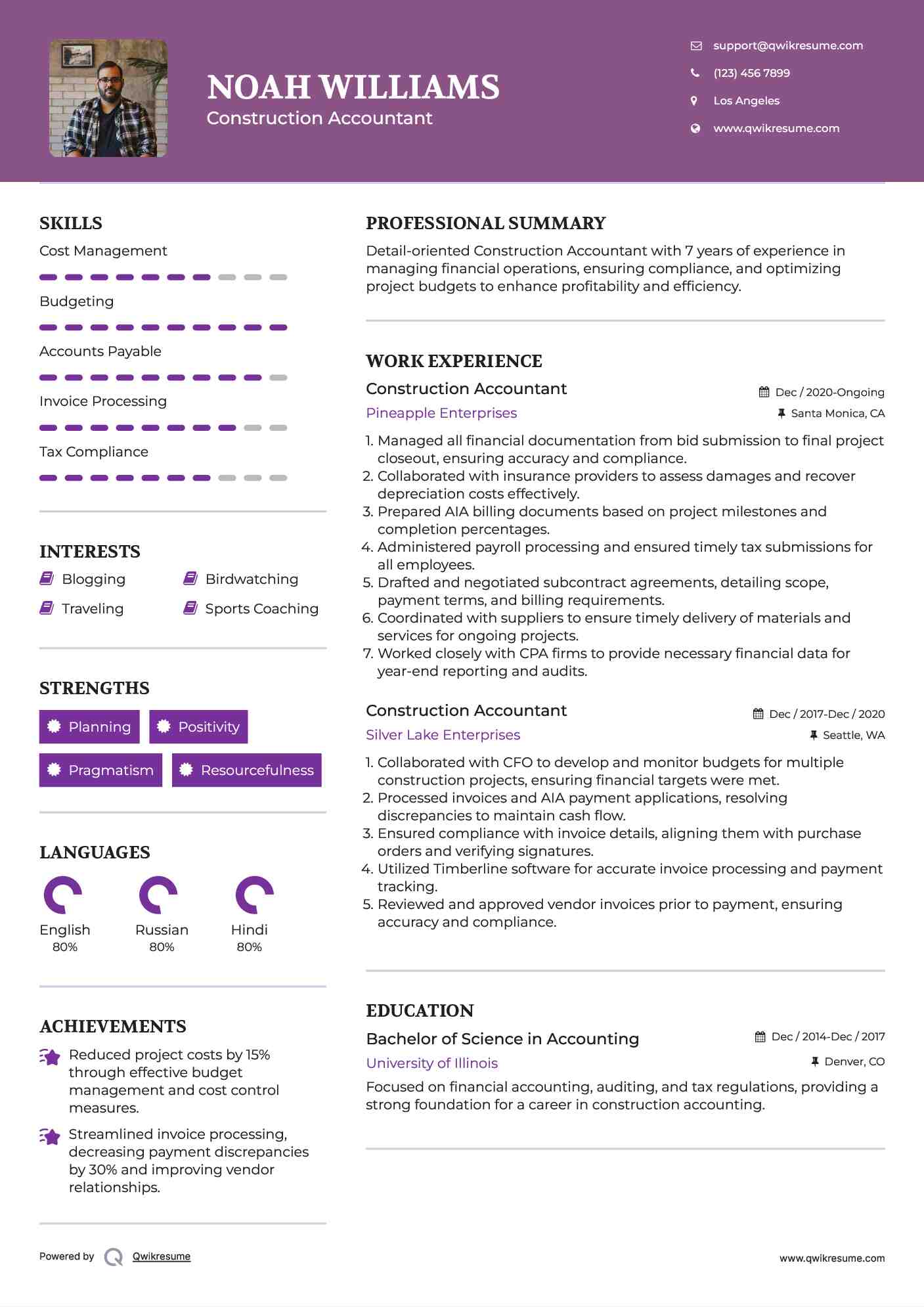

You will certainly assist sustain the Accel group to guarantee distribution of effective in a timely manner, on budget, tasks. Accel is seeking a Construction Accounting professional for the Chicago Office. The Building Accounting professional carries out a selection of bookkeeping, insurance compliance, and task management. Works both individually and within particular divisions to keep financial documents and ensure that all documents are kept present.

Principal tasks consist of, but are not limited to, taking care of all accounting features of the company in a timely and precise way and supplying records and schedules to the company's CPA Firm in the prep work of all monetary declarations. Makes certain that all accounting procedures and functions are managed accurately. In charge of all monetary documents, pay-roll, financial and day-to-day procedure of the audit feature.

Works with Task Supervisors to prepare and upload all month-to-month billings. Generates month-to-month Job Cost to Date records and functioning with PMs to resolve with Project Managers' spending plans for each job.

The smart Trick of Pvm Accounting That Nobody is Discussing

Proficiency in Sage 300 Building and Realty (formerly Sage Timberline Workplace) and Procore construction monitoring software application a plus. https://on.soundcloud.com/9d9WZsCyJwqD36ob6. Need to likewise be proficient in various other computer system software application systems for the prep work of reports, spread sheets and various other bookkeeping evaluation that may be needed by management. construction taxes. Have to possess strong organizational abilities and capability to prioritize

They are the economic custodians who guarantee that construction jobs continue to be on spending plan, abide with tax policies, and preserve monetary transparency. Construction accounting professionals are not simply number crunchers; they are calculated partners in the building procedure. Their key role is to manage the monetary facets of building tasks, ensuring that sources are alloted successfully and economic risks are reduced.

All About Pvm Accounting

By keeping a limited hold on job finances, accounting professionals help avoid overspending and monetary troubles. Budgeting is a foundation of effective construction projects, and construction accounting professionals are crucial in this respect.

Building accounting professionals are fluent in these regulations and guarantee that the job abides with all tax obligation demands. To succeed in the duty of a construction accountant, people require a solid educational foundation in audit and finance.

Furthermore, accreditations such as Licensed Public Accountant (CPA) or Certified Construction Sector Financial Specialist (CCIFP) are extremely concerned in the market. Construction projects frequently involve limited target dates, changing policies, and unexpected expenses.

The Best Strategy To Use For Pvm Accounting

Expert qualifications like certified public accountant or CCIFP are likewise extremely suggested to demonstrate competence in building accountancy. Ans: Building accountants produce and keep an eye on budget plans, determining cost-saving chances and making sure that the project remains within budget plan. They also track expenses and projection monetary needs to avoid overspending. Ans: Yes, building accounting professionals take care of tax conformity for building jobs.

Introduction to Building Bookkeeping By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction firms need to make difficult options amongst several monetary choices, like bidding process on one project over one more, picking funding for materials or devices, or establishing a task's revenue margin. Building and construction is a notoriously volatile sector with a high failure price, slow time to payment, and irregular cash circulation.

Manufacturing includes repeated procedures with easily recognizable costs. Production requires various processes, products, and equipment with varying prices. Each project takes place in a brand-new area with varying site the original source conditions and unique difficulties.

5 Easy Facts About Pvm Accounting Described

Durable partnerships with suppliers reduce negotiations and improve efficiency. Inconsistent. Frequent use of different specialty specialists and distributors influences performance and cash flow. No retainage. Repayment gets here in full or with routine payments for the full contract amount. Retainage. Some part of settlement may be kept till job conclusion also when the contractor's job is completed.

While typical producers have the benefit of controlled atmospheres and maximized production procedures, construction business must frequently adapt to each brand-new project. Also somewhat repeatable tasks need adjustments due to website conditions and other variables.

Report this page